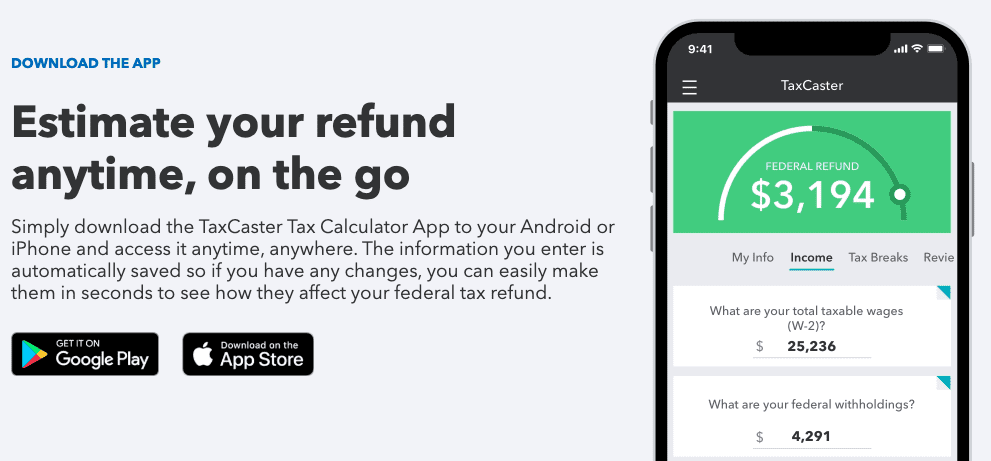

This form is mailed out in late January for the prior tax year. However, distributions from an IRA are reported to you and the IRS on a Form 1099-R. Based on aggregated sales data for all tax year 2021 TurboTax products. Interest postings to IRAs are not reportable. The TurboTax TaxCaster is an all-in-one online tax tool that helps you work out. Special note about Individual Retirement Accounts (IRAs) With our TaxCaster tool, you can quickly estimate how big your tax refund could be, even before you start filing your taxes. To issue you a Form 1099-INT, TD Bank reviews all of your account relationships (interest-earning accounts like checking, savings, money market and CD accounts) and sends one Form 1099-INT to cover all of your accounts in which you are the primary owner. If this applies to you, then you can expect to receive your tax information within the first two weeks of February. Typically, TD Bank mails 1099 tax forms to applicable customers in late January. If they are listed second on the account, they would be considered the secondary owner. You may co-own an account(s) with another person – spouse, partner, child, etc. If you are listed first on an account, you are considered the primary owner. Only the primary owner will receive a Form 1099-INT. For individuals, the Tax ID number is typically your Social Security number.

Form 1099-INT is produced if the aggregated interest earned for a particular Tax ID number is $10 or more.

0 kommentar(er)

0 kommentar(er)